RESEARCH SECTOR

Enterprise productivity

Tools and platforms that enhance enterprise productivity are pivotal in a digital-first world. We seek out innovative companies that automate processes, facilitate collaboration and empower businesses to operate more efficiently and effectively.

Discover the latest trends and technologies shaping enterprise productivity

"*" indicates required fields

Key themes and focus areas

Our work in enterprise productivity focuses on tech companies that use automation and analyze data to achieve more efficient operations and enhanced asset performance.

- Lending tech

- Real estate tech

- Wealth tech

- Insurance tech

In many industries, businesses rely on manual processes or outdated metrics to manage assets, whether those assets be loan portfolios, large real estate portfolios, or other investment holdings. By using technology, these firms can achieve better financial performance while lowering risk.

Our research has focused on high-value-added technologies with macroeconomic tailwinds.

Featured insights and research reports

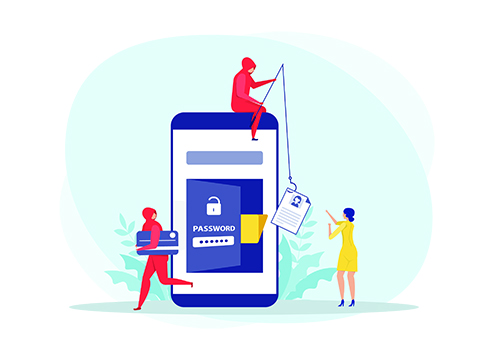

Fraud fighters: Tech innovators address increasingly sophisticated, growing threats

Terry Kiwala, Walid Elmekki

Will this tenant pay? Tech helps find a better answer

Terry Kiwala, Walid Elmekki

From asset purchases to operations, tech still center stage in real estate

Terry Kiwala, Walid Elmekki

Multifamily landlords use leasing automation to counter economic hit of higher rates

Terry Kiwala

Technology for alternative consumer credit scoring will be a large and fast-growing market

Terry Kiwala

Higher interest rates mean higher interest in tech for mortgages

Terry Kiwala

Venture capital activities

Drive My Way

www.drivemyway.comSaaS-based personalized recruiting marketplace for the trucking industry

Learn more

Drive My Way

www.drivemyway.comSaaS-based personalized recruiting marketplace for the trucking industry

Drive My Way’s personalized recruiting marketplace matches commercial driver’s license (CDL) and non-CDL truck drivers and owner operators with jobs based on their professional qualifications and personal lifestyle preferences. Drive My Way is making truck driver recruiting personal again by treating the driver as a consumer in the employment relationship and matching truck drivers with jobs that allow them to live the life they want, doing a job they love. Drive My Way partners with employers to start recruiting for retention, creating meaningful connections employers can turn into lasting relationships.

SynergySuite helps multi-unit restaurants simplify operations and increase profitability with easy-to-use restaurant management software. Businesses have the insights and tools they need to run the back office – all in one place with SynergySuite. Global brands trust SynergySuite’s mobile-first software solution that encompasses inventory, purchasing, recipe costing, food safety, scheduling, cash management, human resources and business intelligence.

Stova is an event technology ecosystem that blends technology with best-in-class service to close gaps in event planning processes. Stova offers event organizers a complete full-service event management solution. The company was formed by combining three unique brands, MeetingPlay, Aventri (formerly etouches) and eventcore. As a unified solution, Stova’s end-to-end event management platform and technology-enabled services support each step of the event life cycle, from event creation, marketing and delivery to analytics and reporting.

Lender Price is a California-based developer of mortgage technology, including an advanced product, pricing, and eligibility (PPE) engine, a digital lending point of sale (POS), and a non-agency automated underwriting engine. Lender Price provides all types of mortgage lending institutions – wholesale and correspondent lenders, banks, credit unions, and mortgage brokers – with advanced technology designed to eliminate friction, increase transparency and effectively engage with borrowers.

Relevant advisory transactions

Exclusive financial advisor

Masttro growth equity investment by FTV Capital

$43,000,000

First Analysis acted as the exclusive financial advisor to Masttro in its $43 million growth equity investment led by FTV Capital.

About Masttro:

Masttro is a leading wealth tech platform that enables a 360-degree view of wealth. The platform provides a single source of accurate data to give wealth owners and their trusted advisors ultimate control, transparency, and peace of mind to make informed, data-driven decisions in real-time. Masttro offers a total wealth overview covering all illiquid and liquid investments including passion assets. It comes with a comprehensive suite of features including direct data aggregation and AI-driven document data extraction to construct the basis for powerful interactive real-time analysis and reporting needs – all protected by best-in-class cybersecurity architecture and data security protocols.

About FTV Capital:

FTV Capital is a sector-focused growth equity investment firm that has raised $6.2 billion to invest in high-growth companies offering a range of innovative solutions in three sectors: enterprise technology and services, financial services, and payments and transaction processing. FTV’s experienced team leverages its domain expertise and proven track record in each of these sectors to help motivated management teams accelerate growth.

Exclusive financial advisor

PCMI Corporation

First equity investment led by Equality Asset Management

Learn moreExclusive financial advisor

PCMI Corp. first equity investment led by Equality Asset Management

First Analysis focuses its advisory services on high-growth, entrepreneur-driven software companies like PCMI. The First Analysis team worked closely with the founder and management team to optimally position the company and find the best partner to help PCMI to continue to achieve its growth objectives. First Analysis was actively engaged throughout the transaction process, including preparation, positioning, investor coordination and contract, due diligence and negotiation.

About PCMI Corp.:

PCMI offers a modular package of software solutions for the administration of finance and insurance products, service contracts and extended warranties. PCMI’s SaaS platform, PCRS (Policy Claim and Reporting Solutions), supports and automates the full lifecycle of all aftermarket products and provides the most flexible environment for administrators, insurers, original equipment manufacturers, agents and dealers to launch new products. Its global team enables continuous around-the-clock innovation and customer-focused support.

About Equality Asset Management:

Equality Asset Management is a growth-focused private equity firm. Equality provides equity capital and strategic and operating support to companies with long-term growth potential in the technology and tech-enabled healthcare sectors. With decades of investment experience and operating experience, the firm has earned a reputation for value-creation, serving as steadfast partners to Founders and CEOs. Equality is based in Boston.

Exclusive financial advisor

Coupa Software convertible senior note

$200,000,000

About Coupa Software:

Coupa Software, based in San Mateo, Calif., provides a unified, cloud-based spend management platform that connects hundreds of organizations representing the Americas, EMEA, and APAC with millions of suppliers globally.

Co-manager

Avison Young senior secured notes

$130,000,000

About Avison Young:

Avison Young is the world’s fastest-growing commercial real estate services firm. Headquartered in Toronto, Canada, Avison Young is a collaborative, global firm owned and operated by its Principals. Founded in 1978, with legacies dating back more than 200 years, the company comprises approximately 5,000 real estate professionals in 108 offices in 14 countries. The firm’s experts provide value-added, client-centric investment sales, leasing, advisory, management and financing services to clients across the office, retail, industrial, multi-family and hospitality sectors. Avison Young is a 2019 winner of the Canada’s Best Managed Companies Platinum Club designation, having retained its Best Managed designation for eight consecutive years.

Investment banking and corporate finance services are provided through First Analysis Securities Corporation (“FASC” or “First Analysis Securities”), a subsidiary of First Analysis Corp.